iowa property tax calculator

This calculation is based on 160 per thousand and the first 50000 is exempt. Property taxes may be paid in semi-annual installments due September and March.

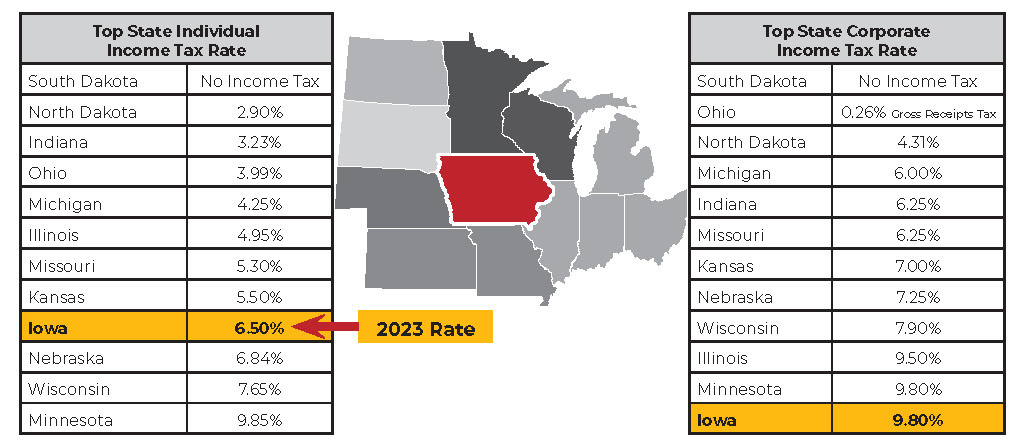

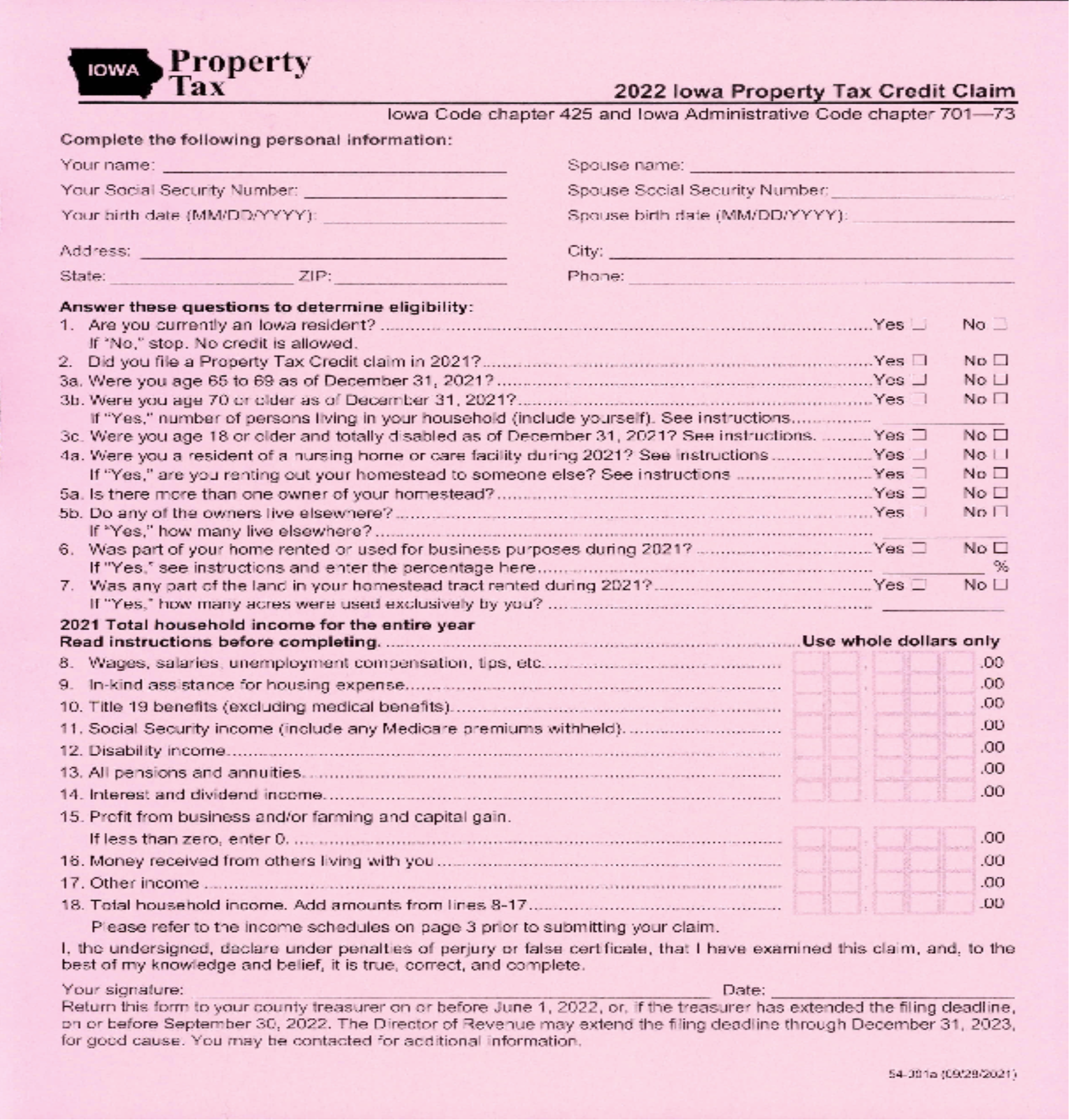

Iowa Still Has High Income Tax Rates Iowans For Tax Relief

Other credits or exemptions may apply.

. The Amount Payable Online represents all taxes that are payable online for each. To use the calculator just enter your propertys current market value such as a current appraisal or a recent purchase price. You may calculate real estate transfer tax by entering the total amount paid for the.

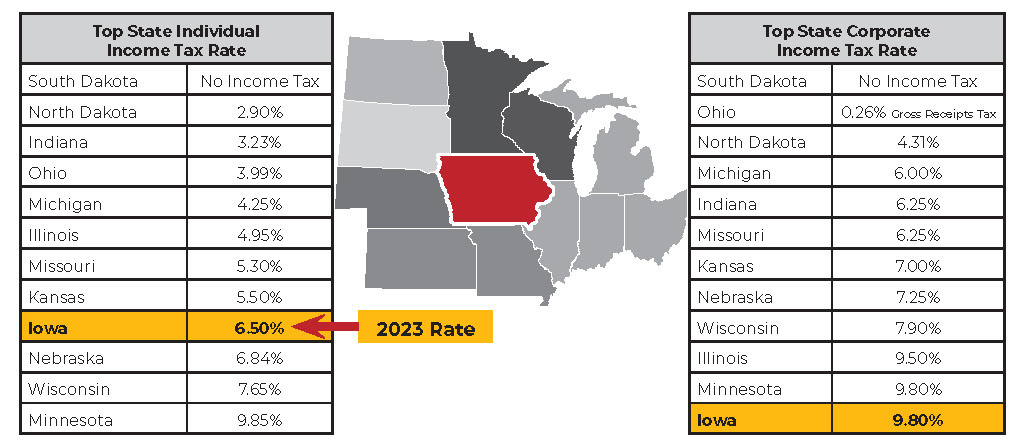

Division 28 of that bill expanded eligibility for the property tax credit under Iowa Code chapter 425 subchapter II based on. 1932-1939 50 per 500. NOTICE Effective August 16 October 31 2022.

2 Tax levy is per thousand dollars of value. Iowa County Iowa - Real Estate Transfer Tax Calculator. Many of Iowas 327 school districts levy an income surtax that is equal to a percentage of the Iowa taxes paid by residents.

2 days agoHeres a simplified example. If you would like to update your Iowa withholding. Iowa Real Estate Transfer Tax Calculator Enter the total amount paid.

- Dallas County Iowa Courthouse 801 Court Street Rm. Annual property tax amount. Annual property tax amount.

So if you pay 2000 in Iowa state taxes and. The median property tax in Iowa is 129 of a propertys assesed fair market value as property tax per year. Total Amount Paid Rounded Up to.

In 2021 the Iowa legislature passed SF 619. That means that when paying. For comparison the median home value in Dubuque County is.

The property tax estimator assumes that property taxes are paid on September 1st and March 1st. Both long- and short-term capital gains are taxed at the full Iowa income tax rates depending on your income tax bracket. Fields notated with are required.

Credits and exemptions are applied only to annual gross net taxes total. But if it stays at 75000 in 2023 youll only owe 1180750 a difference of. To use the calculator just enter your propertys current market value such as a current appraisal or a recent purchase price.

The Iowa property tax is primarily a tax on real property which is mostly land buildings structures and other improvements that are constructed on or in the land attached to the land. Additional withholding cannot exceed your taxable wages less your federal withholding for a pay period. Iowa property taxes are paid in arrears.

Tax amount varies by county. Get Involved - Volunteer. 1940-1967 55 per 500 1st 100 exempt 1968.

For comparison the median home value in Clinton County is. 1 2018 State of Iowa Rollback - Residential Class - gross taxable value is rounded to the nearest 10. If your taxable income is 75000 in 2022 youll owe 12117 in taxes.

Iowa is ranked number twenty eight out of the fifty. This Property Tax Calculator is for informational use only and may not properly. Iowa Tax Proration Calculator.

For comparison the median home value in Iowa is 12200000. Iowa Tax Proration Calculator Todays date. Iowa Capital Gains Tax.

The calculation is based on 160 per thousand with the first 500 being exempt. To use the calculator just enter your propertys current market value such as a current appraisal or a recent purchase price.

Wdmhomes Mark Bunge Realtor Where Does Iowa Rank Nationally In Property Tax Rates

Iowa Legislature Factbook Map Of The Week

Property Taxes Marion County Iowa

Changes To Taxes For Communications Companies In Iowa Forvis

Governor S Tax Plan By The Numbers Iowans For Tax Relief

Iowa Legislature Factbook Map Of The Week

States With The Highest Lowest Tax Rates

Property Tax Backfill Iowa League

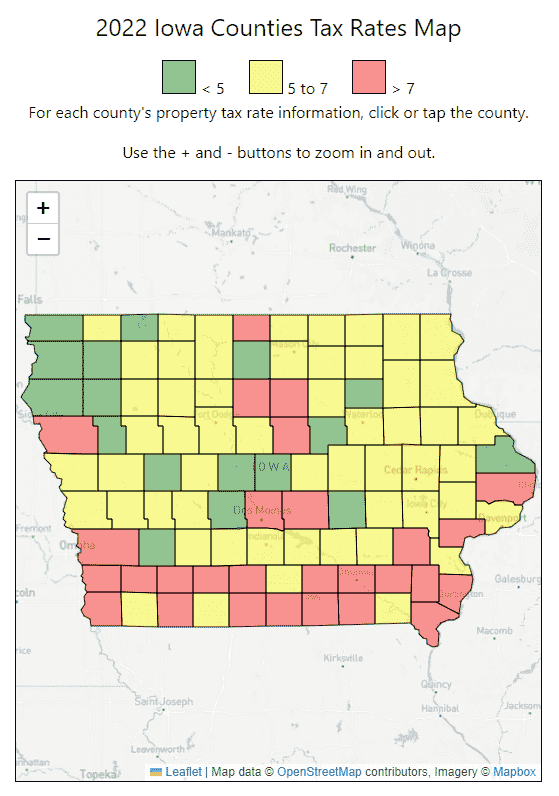

2022 Iowa County Property Tax Rates

Minnesota Property Taxes Not The Worst But Could Be Better American Experiment

Property Tax Calculator Casaplorer

2022 Iowa Tax Brackets New 2026 Iowa Flat Tax 0 Retirement Tax

Iowa Announces Property Tax Rollback Ke Andrews

How Do State And Local Corporate Income Taxes Work Tax Policy Center

Property Tax Calculator Smartasset

Real Estate Records Polk County Iowa

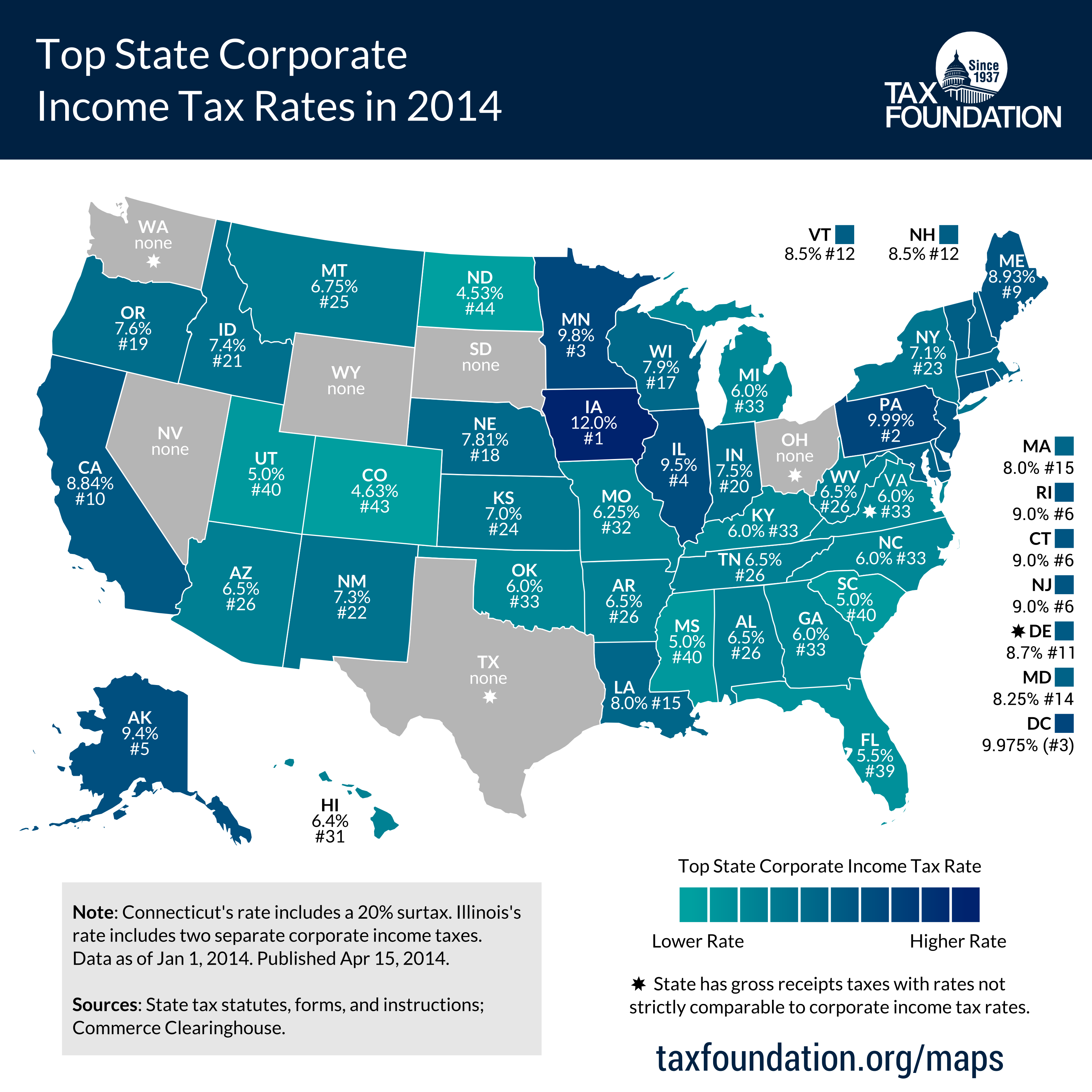

Top State Corporate Income Tax Rates In 2014 Tax Foundation

Iowa S Largest Property Tax Cut Fails To Deliver Investigation Finds